SEPA using IBAN for Payments

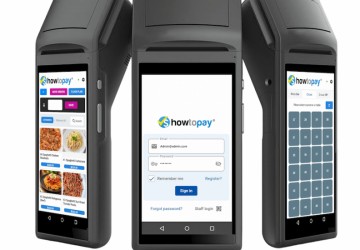

HowToPay has now launched SEPA Instant Payments allowing customers to send and receive SEPA payments in Europe.

Incoming SEPA / IBAN payments using our Payment Request API can be fully automated. This allows client websites and billing systems to get notifications of incoming transactions electronicly.

The Single Euro Payments Area (SEPA) is a payment-integration initiative of the The Single Euro Payments Area (SEPA) is a payment-integration initiative of the European Union (EU) for simplification of bank transfers denominated in euro. As of 2019, there were 34 members in SEPA, consisting of the 28 member states of the European Union, the four member states of the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland)and two more. Some countries participate in the technical schemes: Andorra,Monaco, San Marino, and Vatican City.

The aim of SEPA is to improve the efficiency of cross-border payments and turn the previously fragmented national markets for euro payments into a single domestic one. SEPA enables customers to make cashless euro payments to any account located anywhere in the area, using a single bank account and a single set of payment instruments. People who have a bank account in a eurozone country, will be able to use it to receive salaries and make payments all over the eurozone. SEPA is now the standard for how things are paid across all Europe.

The project includes the development of common financial instruments, standards, procedures, and infrastructure to enable economies of scale. This should, in turn, reduce the overall cost to the European economy of moving capital around the region.

SEPA does not cover payments in currencies other than the euro. This means that domestic payments in SEPA countries not using the euro will continue to use local schemes, but cross border payments will use SEPA and euro against eurozone countries.

HowToPay assists merchants to accept SEPA payments in Europe and then transfer them anywhere in the world.

All this makes SEPA an attractive option for businesses. However before rolling it out, it is important to understand a couple of things:

Unlike credit cards, SEPA does not have an additional authentication layer, such as a CVC check or 3D Secure. Consequently it is important to have good risk management tools in place to offset the threat of fraud. This includes the requirement for KYC / Identification for each and every transaction. HowToPay assists you by requesting and validating uploaded ID by a real person 24/7 to help you verify who you are dealing with.

A client can perform a SEPA chargeback online up to eight weeks after the purchase, with no questions asked. And in some extreme cases this can be as much as 13 months.

If you are looking to receive payments in Europe please contact us to assist you setup quickly and easily.

Apply here: https://news.howtopay.com/news/apply

-

04/06/2023 1598

04/06/2023 1598 -

03/08/2024 579

03/08/2024 579 -

02/17/2024 606

02/17/2024 606 -

02/17/2024 682

02/17/2024 682 -

02/17/2024 602

02/17/2024 602

-

11/22/2023 3120

11/22/2023 3120 -

11/07/2022 2827

11/07/2022 2827 -

09/20/2023 2584

09/20/2023 2584 -

09/29/2023 2575

09/29/2023 2575 -

07/22/2022 2546

07/22/2022 2546

FEATURED NEWS

NEWS

PAYMENTS

NEWS

PAYMENTS

LEAVE A COMMENT