ALERT: The QR Code Receipt Scam

Mobile Payments QR PromptPay Scam Threatens Small Businesses in Thailand

In Thailand, the widespread adoption of cashless payments has made life more convenient for millions, with the PromptPay system now accounting for as much as 80% of transactions conducted via QR code on mobile banking platforms. However, this shift towards digital payments has given rise to a new and insidious form of fraud, which is increasingly targeting small businesses.

The QR Code Receipt Scam

A scam involving fake QR code receipts is on the rise, and it’s catching thousands of small business owners off guard. The scam exploits the common practice of displaying a single PromptPay QR code on a shop’s counter, which was initially seen as a simple solution for receiving digital payments.

Scammers have developed a deceptive mobile application designed to mimic genuine banking apps. When a scammer scans a store’s PromptPay QR code using this fraudulent app, they can enter a payment amount and generate a fake receipt. The receipt screen appears authentic, complete with the transaction amount, date, and time, closely resembling the legitimate confirmation screens issued by banks.

However, this app is entirely disconnected from any real bank. The store, in reality, receives no money, but the busy staff may not notice this, especially during peak hours. This scam can cause significant financial losses, particularly for small businesses that rely heavily on PromptPay transactions.

Easy Access to Fraudulent Tools

Alarmingly, copies of the fake receipt app are being sold on social media platforms in Thailand for as little as 500 Thai baht. Scammers openly advertise the app with claims that users can “save on dining and shopping” by generating fake payment receipts. Many small businesses, unaware of the scam, are left vulnerable to these fraudulent activities.

Inside Job Risks

In addition to external scams, internal fraud has also become a concern. A restaurant owner recently reported an incident where staff members swapped the official PromptPay QR code on the menu or counter with their personal QR codes, redirecting customer payments into their own bank accounts. This type of fraud is becoming increasingly common, making it crucial for business owners to implement tighter controls.

How to Protect Your Business

Small businesses are advised to adopt measures that can prevent these types of fraud:

-

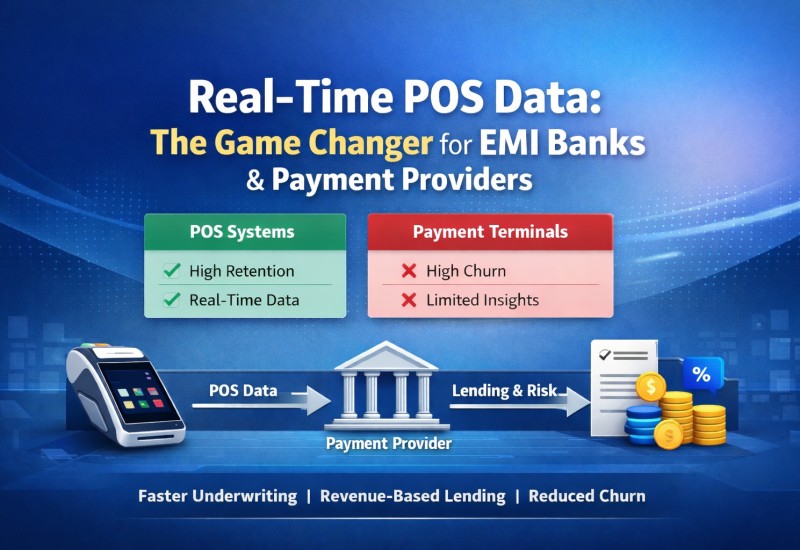

Use a POS System Linked to the Bank: Instead of relying solely on static QR codes, businesses should use a POS system directly connected to their bank. This ensures real-time confirmation of payments.

-

Install the Bank’s Official Mobile App: Ensure that the store’s staff has access to the official banking app, which provides immediate notifications of incoming payments.

-

Provide Staff with Access to Real-Time Payment Reports: Allow staff to verify every payment by checking the official payment reporting system.

-

Monitor Payment Activity Remotely: For business owners who are not present at their establishment full-time, a POS system that provides instant updates and reports on payments is essential.

HowToPay POS: A Reliable Solution

One recommended solution to combat these scams is the HowToPay POS system. This modern POS system offers several key features to protect businesses:

-

Unique PromptPay QR Codes for Each Bill: HowToPay POS generates a unique QR code for every bill, reducing the risk of fraud through QR code swapping.

-

Live Bank Feedback: The system provides real-time updates on whether the correct payment has been received, ensuring accuracy.

-

Automated Record Keeping: HowToPay POS automatically updates the system, minimizing human error and enabling easy verification of transactions.

Final Thoughts

As digital payments continue to dominate in Thailand, small businesses must stay vigilant against emerging scams. By adopting secure POS systems and maintaining strict payment verification protocols, they can protect themselves from financial fraud and ensure the integrity of their transactions.

Stay safe, stay informed, and take proactive steps to safeguard your business from the evolving threats in the cashless payment landscape.

For a better POS solution for your business, see www.howtopay.com

Source: https://www.howtopay.com/