Market Access Now Depends on Software and Compliance

Europe Has Changed the Rules — Compliance Is Now Mandatory

The global POS industry has entered a new phase. Regulatory change in Europe—most notably Germany’s Technical Security requirements (TSE/TSA)—has permanently altered how POS solutions must be designed, sold, and supported.

This is no longer a future consideration. Many POS products that are widely sold in other markets are not legal for use in the European Union today. Systems that were not designed with fiscal security, auditability, and compliant data storage at their core cannot simply be updated later.

For hardware manufacturers, this creates a clear and immediate reality: non-compliant hardware–software combinations are excluded from regulated European markets.

Hardware Is Commoditised — Market Access Now Depends on Software and Compliance

POS hardware has reached a high level of maturity. Performance differences are minimal, pricing is highly competitive, and differentiation at the device level continues to compress margins.

As a result, buying decisions are no longer driven by hardware alone. Merchants, distributors, banks, and payment providers evaluate POS solutions as business platforms, where software capability, compliance readiness, and long-term support determine viability.

Hardware without compliant, modern software is no longer a product advantage—it is a barrier to sale.

A Critical Hardware Reality Many Manufacturers Overlook

European compliance does not only affect software. It directly impacts hardware design requirements.

For example, to meet offline fiscal security requirements in markets such as Germany, POS hardware must support secure, tamper-resistant storage—commonly implemented via dedicated SD card slots for TSE/TSA-certified memory.

Hardware that cannot physically support these requirements cannot be legally deployed, regardless of the quality of the software running on it.

This is strategic information many manufacturers only discover after entering the market—often too late. Partnering early with a software provider that understands the global regulatory impact on hardware design is now essential to avoid costly redesigns and lost sales cycles.

Why Selling Hardware Alone Is No Longer the Future

The POS industry has shifted from one-time device sales to long-term platform relationships.

Merchants expect POS systems to manage:

-

Daily operations and staff workflows

-

Accounting, reporting, and audit readiness

-

Secure transaction records

-

Regulatory compliance across jurisdictions

-

Integration with banks, payment providers, and third-party services

Hardware sold without a compliant, continuously maintained software platform turns into a short-lived transaction rather than a long-term commercial relationship.

HowToPay POS: A Compliance-First Platform Built for Market Access

HowToPay POS is a cloud-first, enterprise-grade POS platform designed specifically for modern regulatory and commercial realities.

Compliance is not treated as an add-on. It is a foundational design principle, enabling deployment into regulated markets where many existing POS solutions cannot operate.

Key capabilities include:

-

Secure, auditable transaction architecture aligned with European requirements

-

Cloud management with real-time synchronisation and off-site backups

-

Centralised control for single and multi-location merchants

-

Continuous software updates and lifecycle management

-

Accounting- and reporting-ready data structures

For hardware manufacturers, this transforms devices from isolated products into market-accessible, compliant platforms.

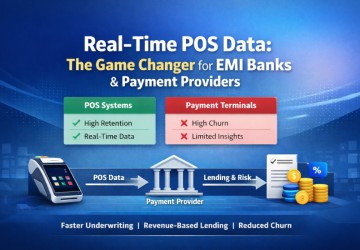

Open APIs Unlock Distribution Through Banks and Payment Providers

A POS system locked to a single payment provider can only ever serve a limited market.

HowToPay POS is built around modern, open APIs that allow banks, EMIs, PSPs, and financial platforms to integrate directly into the POS ecosystem.

This enables:

-

Greater distribution through financial institutions

-

Faster merchant adoption via existing banking relationships

-

Deployment across multiple countries without hardware redesign

-

Reduced dependency on any single payment provider

For hardware manufacturers, this means one device platform can support multiple markets, partners, and revenue channels.

Brand Clarity Accelerates Hardware Sales

In regulated and enterprise environments, brand clarity directly impacts sales velocity.

Abstract or invented POS brand names require explanation before trust is established, slowing sales cycles and increasing friction for distributors.

HowToPay is intentionally clear and descriptive. The brand immediately communicates what the system does and why it exists—helping merchants understand how to take payments and operate their business efficiently.

This clarity delivers measurable benefits:

-

Faster understanding by merchants and partners

-

Shorter sales and onboarding cycles

-

Easier positioning for distributors and resellers

-

Stronger trust with banks, auditors, and regulators

A Partnership Model That Protects Margins and Market Access

By partnering with HowToPay POS, hardware manufacturers can:

-

Protect margins in a commoditised hardware market

-

Avoid the cost and risk of building compliant POS software internally

-

Access regulated European markets with confidence

-

Participate in long-term software and services revenue

-

Increase merchant retention and hardware lifecycle value

This model allows manufacturers to focus on hardware excellence while partnering with specialists who manage software complexity, compliance, and ongoing updates.

The Risk of Delay

Regulatory standards are accelerating—not slowing down.

Manufacturers that delay adapting to compliance-driven POS requirements risk:

-

Exclusion from regulated markets

-

Forced hardware redesigns

-

Loss of distributor and banking partnerships

-

Declining competitiveness against compliant alternatives

The POS industry is no longer defined by hardware alone. It is defined by market access, compliance, and platform capability.

Let’s Build the Next Generation of POS Together

HowToPay POS is actively seeking hardware manufacturing partners who recognise that the future of POS is not one-off device sales, but long-term, compliant platform relationships.

Partnership Enquiries

Mr Cameron McKean

Chief Executive Officer

Confidia Limited

Email: [email protected]

-

12/22/2025 41

12/22/2025 41 -

12/21/2025 10

12/21/2025 10 -

12/21/2025 12

12/21/2025 12 -

12/21/2025 8

12/21/2025 8 -

12/21/2025 8

12/21/2025 8

-

09/20/2023 4871

09/20/2023 4871 -

11/15/2023 4248

11/15/2023 4248 -

07/23/2022 4155

07/23/2022 4155 -

09/30/2023 4139

09/30/2023 4139 -

11/14/2023 3887

11/14/2023 3887

FEATURED NEWS

NEWS

NEWS

PAYMENTS

POS

LEAVE A COMMENT